Public Banking beyond the East Bay

The Friends of the Public Bank East Bay is a founding member of the California Public Banking Alliance, a network of 10 active groups advocating for the creation of local public banks from San Diego in the South to Humboldt County in the North. In 2019 the Alliance successfully passed the California Public Banking Act (AB 857), the first public banking law in the US in a hundred years, the result of a major grassroots effort with support from activists from across the state.

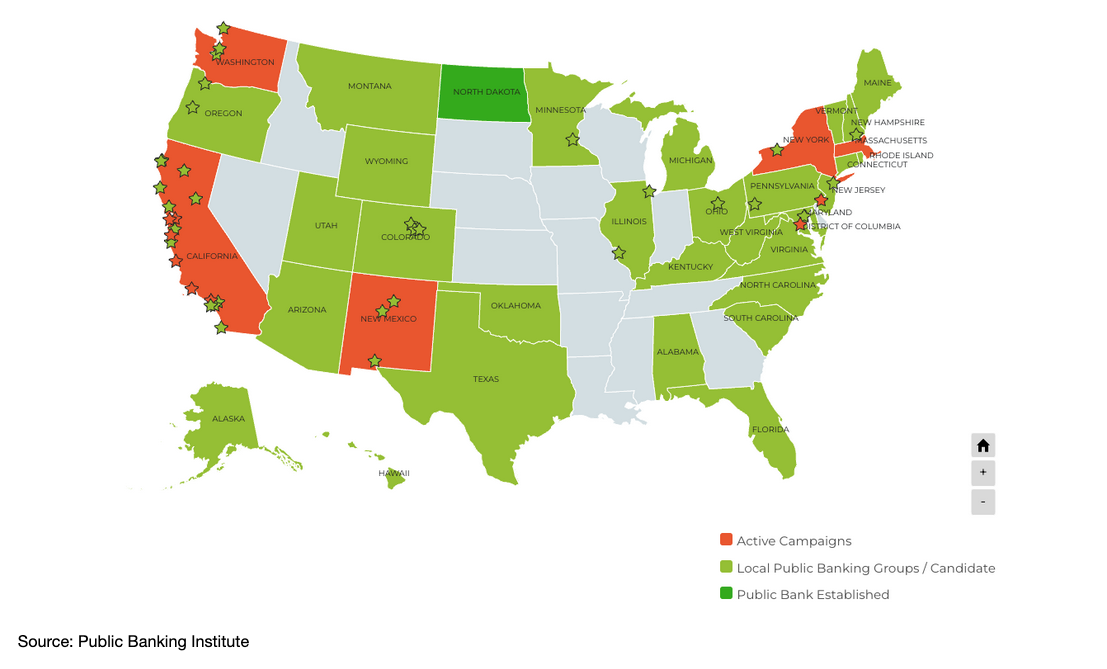

The Public Banking Institute supports local efforts across the US by providing research and legislative support, organizing town halls, and developing educational materials.

California Public Banking Initiatives

Since the passing of the California Public Banking Act in 2019, cities and counties across the state engage in a friendly competition to start the first municipal public bank in the US in a hundred years. Along with the East Bay the following groups are the closest to get a bank started in the near term:

Los Angeles : In October 2021, the LA city council unanimously voted to move forward with the creation of a public bank for the city of LA. The next step for the city is to hire a consultant to write the business plan. Watch their 2021 community teach-in here.

San Francisco : In June 2021 the Board of Supervisors unanimously voted to create a task force exploring the creation of a public bank. The task force includes seven leaders in the realm of community finance and affordable housing development. The City and County has hired the HR&A Team as a consultant, and that Team has published its Lending Gaps and Priorities Analysis for San Francisco.

People for Public Banking Central Coast : Activists and politicians from 3 counties and 7 cities have merged their efforts to create a regional public bank reaching communities from Santa Barbara to Santa Cruz. They are soon expected to issue an RFP for a viability study.

Nationwide Public Banking Initiatives

Washington D.C.: On December 13, 2023, Congresswoman Rashida Tlaib (MI-12) and Alexandria Ocasio-Cortez (NY-14) introduced the Public Banking Act of 2023, which facilitates the creation of state and local public banks. The bill establishes a robust federal regulatory framework, grant programs, and financial infrastructure to promote public banks and ensure their success. The bill also mandates minimum standards for public banks relating to environmental justice, tenant protections, labor standards, democratic governance, and consumer data privacy.

The full text of the bill is available here. You can follow the bill here.

New York : In 2021 the “New York Public Banking Act” was introduced into the state senate. Similarly to the California Public Banking Act this bill would create the legal pathway to create local public banks in the state. New York City and the city of Rochester are currently working with their city councils to move forward with local public banks. Watch their 2021 town hall with keynote speaker Eric Hardmeyer (former CEO of the Bank of North Dakota) here.

Check out this 2023 Publication:

Massachusetts : For the second time in 10 years a law to create a public bank for the state of MA was introduced to the state senate in 2021. The bill would immediately capitalize the bank with $200MM from the state general fund. Watch their January 2022 press conference here.

City of Philadelphia : On March 3, 2022, the city council voted 15-1 to establish the “Philadelphia Public Financial Authority”, a first step to create a Public Bank for Philly. More details in their proposal can be found here. Watch their 2021 town hall with public banking experts from across the country here.

Other active public banking campaigns are popping up across the US:

Check out the website of the Public Banking Institute for most recent updates

Bank of North Dakota

The Bank of North Dakota (BND) was founded in 1919 and has been financially very successful returning over $1Bn to the state general fund in its first 100 years and in recent years being more profitable than Wall Street Banks.

BND primarily operates as a “banker’s bank” partnering with existing local financial institutions providing loans for infrastructure and small businesses at interest rates as low as 2% (learn more about their 14+ loan programs on their website).

Because of the support of the BND, North Dakota today has the highest density of banks per capita in the US and community banks and credit unions hold 83% of all deposits (vs. 29% in the US). More info here.

BND has helped North Dakota weather the recent financial crises comparably well. In 2008 North Dakota was the only state in the US that increased its business lending and in 2020 it has distributed the most PPP loans per worker than any other state.

Watch BND’s former CEO, Eric Hardmeyer, speak at a recent town hall.

Bank of American Samoa

In 2018 the US territory American Samoa created a public bank addressing the lack of any other lending institution in the territory providing loans and banking services. The bank has since been converted to a private bank. While the scope of the bank was much more limited than other current proposals (the population in the islands is only about 60,000) and focussed on providing retail services to local residents rather than being a banker’s bank for the government, and its existence was limited, the approval of the public bank by the federal regulators has set an important precedent that public banks can be created today.

Public Banks outside the US

Public Banks are very common in many countries outside the US. In fact, more than one quarter of all financial assets worldwide are being held by publicly owned banks. From Costa Rica to Germany to India, public banks have existed in many different shapes and sizes, in the case of the German savings banks for more than 200 years. Public Banks are a proven concept that can work in the US like anywhere else.

Learn more about public banks outside the US in the 2021 survey “Public Banking Around the World: A Comparative Survey of Seven Models” and the 2021 book “Public Banks and COVID-19” that features how public banks were crucial in fighting the economic consequences of the pandemic.